So far, the company has received nearly 50,000 reservations.

The Rivian has been finally available for testing, and our InsideEVs colleagues were delighted to do so. The overall impression of the vehicle was ” the ultimate electrical adventure vehicle”. Reviews from other outlets also shared similar views. The electric truck appears to be perfect, but the financial situation behind the scenes isn’t the same.

The company filed an Initial Public Offer with the US Securities and Exchange Commission last week. It set a placeholder price at $100 million. However, this number could change once terms for the share sale are established. Automotive News reports that 48,390 customers have made a $1,000 refundable deposit for the R1T or R1S electric models. This is just the beginning of the story.

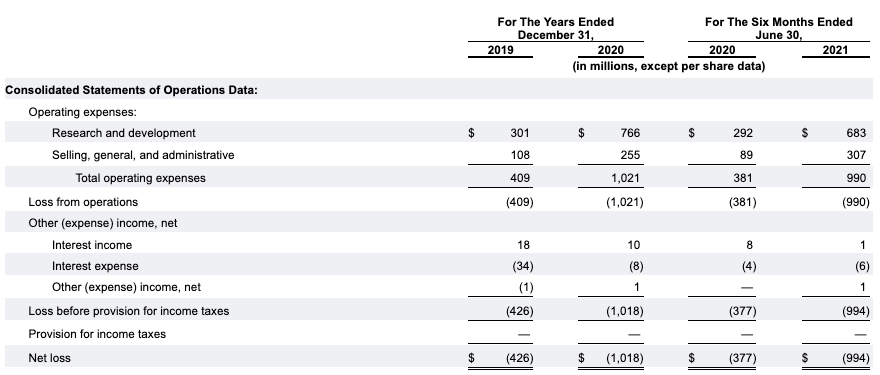

According to the filing, the Amazon-backed company lost $994 million in the first six months. The filing also shows that Rivian had a deficit in the same period last fiscal year of $377 million. The company had $3.7 billion in cash and cash equivalents as of June 30, to finance its operations. The company is currently making very little revenue from the sale of products.

Rivian’s relationship to Amazon is also revealed in the filing. The automaker will need to deliver 100,000 last mile trucks to the ecommerce company by 2030. The first 10,000 should be delivered this year. Amazon will be the exclusive owner of Rivian’s electric delivery cars for four years, with the possibility to exercise the right for first refusal for two additional years.

Rivian’s CEO Robert Scaringe wrote to potential investors, “Rivian exists in order to create products, services, and energy that help our planet transition towards carbon-neutral energy, and transportation.” I hope you’ll be part of our journey to drive the future transportation.