It is amazing to see the difference between the most and least expensive.

Auto insurance. Owning a car in the United States is a must. However, not all policies are created equal. Prices can vary depending on many factors. Some of these factors make sense, such as the level of coverage. Others are less well-known, with some arguing that factors such as credit scores, age, and location can lead to discrimination. No matter where you stand on this issue, there is one certainty: auto insurance prices can vary based on where you live.

Carinsurance.com did a deep dive into the average insurance cost for each state and city in the United States. The website provided quotes from six major insurance companies using a 2017 Honda Accord as the vehicle and a driver with a clean driving record. These quotes were for policies that met minimum state requirements regarding liability coverage and had a $500 deductible.

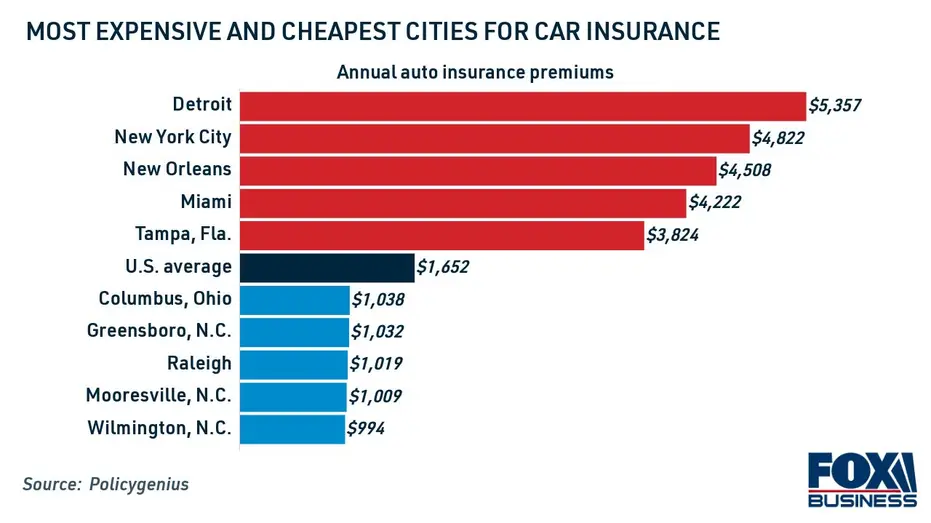

Which cities are most expensive? Michigan’s no-fault insurance system is known for being very expensive. Detroit is the most expensive. Average insurance costs in Michigan are $6,329. This is roughly $527 per month. It’s also the same price as a monthly car payment for a new vehicle priced at $35,000. New York comes in second with $5,703 per year, followed by New Orleans (at $4,601) and Las Vegas (3,768). North Hollywood is the fifth-highest-ranking at $3,767. This is nearly half of the cost of car insurance in the Motor City.

Bridgewater, Maine, however, has the lowest insurance rates in the country at $993 per annum. St. Marys, Ohio, New Hampshire, and Lebanon tie for second at $995. Blacksburg, Virginia is at $1,005 while Menasha, Wisconsin is at $1,080. These figures are based on the 2017 Honda Accord and the same driver, a 30-year-old male. It’s clear that there is a significant difference in cost depending on where you live.

This report shows that the average annual insurance expense for the United States is $1,700.