That’s right. Buyers are being paid by oil producers to purchase their crude reserves for May.

An unusual phenomenon has occurred: The U.S. crude oil price fell to $0.0 today due to a serious drop in demand for fossil fuels.

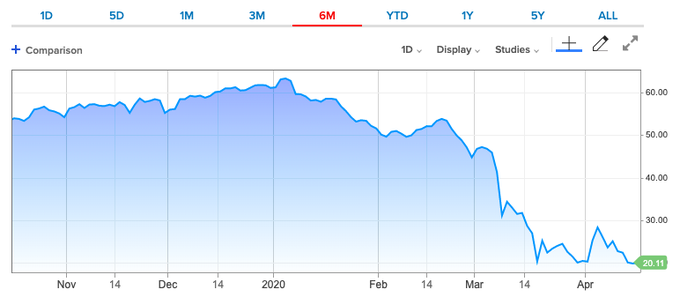

WTI oil futures for May had been sold for $-13.1 as of press time. This indicates that people with oil to sell were buying it from others. The New York Times states that the unusually high oil price is due to how commodities are valued, but it does not necessarily indicate that the commodity is truly worthless. According to the Times, June oil deliveries are priced at $21 per barrel. This is still a 16 percent drop.

The problem is that there aren’t enough places for oil to be stored after it is pumped from the ground. Oil is being stored on barges offshore and in remote parts of the country at the moment. Additional facilities have been rented by oil producers to store the newly pumped oil. Oil producers were eager to dispose of their excess before Tuesday’s May futures contracts expire. They have slashed oil prices and paid to have it removed.

Infighting between OPEC, the U.S. and Russian suppliers is a further problem. To meet the coronavirus fears, global oil companies agreed last month to lower their production. The BBC quotes experts saying that the deal was not sufficient and that there is still too much oil on the market.

The stock market was affected by the abrupt drop in oil prices. Due to large drops in oil prices and travel sector, the S&P 500 dropped 1.8 percent on April 20.